Why U.S. Businesses Are Switching to Remote Services in 2025?

Two out of three CFOs admit they’ve lost sleep over accounting errors that could have been avoided.Not small mistakes—we’re talking about the kind that trigger audits and create financial sinkholes.You’ve felt that knot in your stomach. The one that forms when you realize your in-house team is drowning in paperwork while strategic financial planning collects dust That’s why U.S. businesses are switching to remote accounting services in 2025 at record rates. They’re not just outsourcing bookkeeping—they’re buying back time, reducing overhead, and accessing expertise that would cost six figures to bring in-house

The Economic Advantages of Remote Accounting in 2025

As a founder or small business owner, your time is one of your most valuable assets. When you’re knee-deep in spreadsheets, receipts, or reconciling transactions, that’s time you’re not spending on growing your business. A good accounting partner takes that load off—managing the back-end while you focus on what actually drives your business forward.

1. Significant Cost Reductions Beyond Traditional In-House Teams

The numbers don’t lie. In 2025, businesses are saving an average of 40-60% on accounting costs by going remote.Think about it – no more full-time salaries, benefits packages, or those expensive accounting software licenses that seem to increase every year.

Remote accounting isn’t just cheaper – it’s smarter money management. Companies are redirecting those savings into core business operations and growth initiatives instead of maintaining bloated accounting departments.

What’s really turning heads is the elimination of hidden costs. Remember all those expenses that sneak up on you? Training costs, overtime during tax season, turnover expenses when your accountant leaves for a competitor? Gone.

Here’s what one business owner told me last week: “We cut our accounting budget by 52% while actually improving our financial reporting. I wish we’d done this five years ago.”

2. Scalable Service Models for Businesses of All Sizes

Remote accounting has finally solved the scalability puzzle that’s frustrated businesses for decades.

Need basic bookkeeping today but full financial analysis next quarter when you launch that new productline? Most remote providers now offer tiered service models that flex with your needs – something traditional in-house teams simply can’t match.

Seasonal businesses are particularly loving this approach. A retail client of mine scales up their accounting support during the holiday rush and dials it back during slower months. Their CFO told me: “We’re only paying for what we need, when we need it. It’s transformed our cash flow.”

Even enterprise-level organizations are jumping on board, creating hybrid models where remote teams handle routine accounting tasks while in-house finance leaders focus on strategic initiatives.

3. Elimination of Physical Infrastructure Expenses

Office space in 2025 costs how much per square foot? (I’ll wait while you pick your jaw up off the floor.)

Remote accounting eliminates the need for dedicated workspace, furniture, computers, printers, paper storage, and all those other physical infrastructure costs that eat away at your bottom line.

The math is simple: each in-house accounting employee requires approximately 150 square feet of office space. At current commercial real estate prices, that’s thousands of dollars monthly just for them to have a place to sit.

Companies are reporting savings of $15,000-25,000 annually per accounting position by eliminating these physical requirements. Plus, they’re reducing their environmental footprint – something increasingly important to consumers and investors alike.

4. Access to Premium Financial Expertise Without Premium Salaries

The talent gap in accounting has reached crisis levels in 2025. Finding qualified professionals is harder than ever, and commanding increasingly higher salaries.

Remote accounting services flip this challenge into an opportunity. Instead of competing for scarce talent, you’re tapping into established teams of specialists with diverse expertise.

I spoke with a manufacturing CEO who put it perfectly: “We could never afford a full-time controller with public company experience, but our remote accounting service gives us access to exactly that level of expertise for a fraction of the cost.”

What’s particularly valuable is specialized knowledge. Need someone who understands healthcare billing compliance or crypto tax implications? Remote accounting services can connect you with niche experts without requiring you to hire them full-time.

What’s particularly valuable is specialized knowledge. Need someone who understands healthcare billing compliance or crypto tax implications? Remote accounting services can connect you with niche experts without requiring you to hire them full-time.

Technology Advancements Driving the Remote Accounting Revolution

1. AI-Powered Financial Analysis and Reporting

The talent gap in accounting has reached crisis levels in 2025. Finding qualified professionals is harder than ever, and commanding increasingly higher salaries.

What’s really changed the game? AI that doesn’t just crunch numbers but actually learns from your business patterns. These systems flag unusual spending, predict cash flow shortages before they happen, and suggest optimization strategies specific to your industry.

One finance director I spoke with said, “My team used to spend 30 hours monthly on reports. Now our AI handles it in minutes, and the insights are better than what we produced manually.”

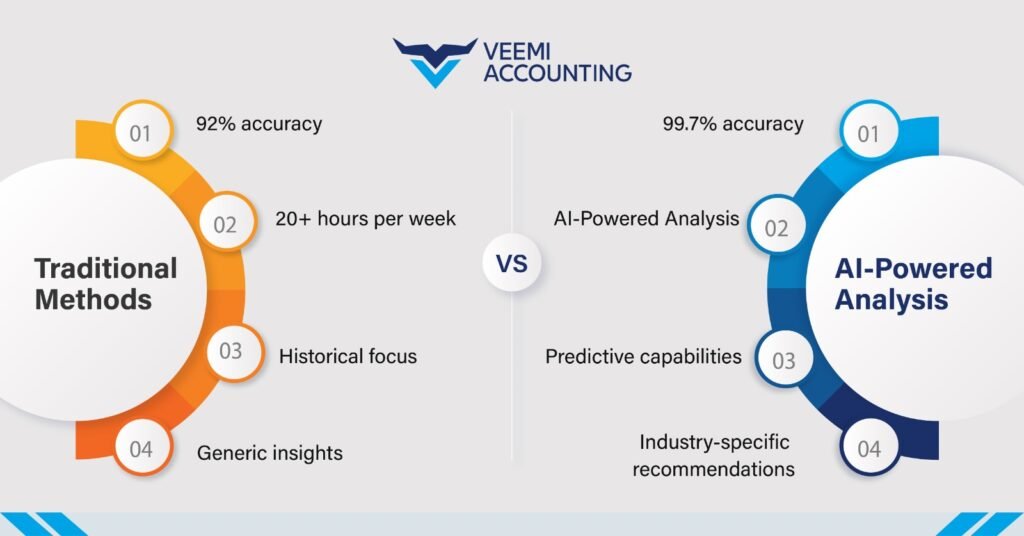

The accuracy improvement is staggering too:

Traditional Methods:

- 92% accuracy

- 20+ hours per week

- Historical focus

- Generic insights

AI-Powered Analysis:

- 99.7% accuracy

- AI-Powered Analysis

- Predictive capabilities

- Industry-specific recommendations

2. Blockchain Integration for Enhanced Security and Transparency

Blockchain isn’t just for crypto anymore. It’s revolutionizing how businesses handle their books.The biggest win? Immutable audit trails. Every transaction gets recorded permanently, making fraud nearly impossible. This technology has cut audit costs by up to 40% for businesses that have adopted it.

Think about this: when every financial move is timestamped and unchangeable, your books become bulletproof. No more reconciliation nightmares or wondering if numbers have been altered.

Companies using blockchain-based accounting report 73% fewer security incidents compared to those using traditional methods. And transparency has improved collaboration with investors, who now have near real-time visibility into financial performance.

3. Cloud-Based Accounting Solutions That Outperform Legacy Systems

On-premise accounting software is quickly becoming as outdated as fax machines.

Cloud solutions have completely transformed what’s possible. Access your books from anywhere,collaborate with your accountant in real-time, and never worry about updating software again.

The processing power difference is dramatic.

Legacy Systems:

- Limited by local hardware

- Manual updates required

- Limited integrations

- Backup complications

- Isolated data

Cloud Solutions:

- Scalable computing power

- Automatic updates

- Hundreds of app connections

- Automatic redundancy

- Collaborative environment

Many businesses report 70% faster month-end close processes after switching to cloud accounting.Plus, implementation costs have dropped dramatically since 2023.

4. Real-Time Financial Dashboards for Immediate Decision Making

The days of waiting until month-end to see how your business is performing are history.

Modern dashboards show your financial pulse in real-time. Cash position, receivables aging, profit margins by product – all available on your phone right now.

This instant visibility is changing how decisions get made. One retail chain owner told me, “We spotted a sudden profit margin drop in our midwest stores and adjusted pricing within hours, not weeks.”

What makes these dashboards different from older versions? Contextual intelligence. They don’t just show numbers but highlight what those numbers mean for your specific business goals.

Businesses using real-time dashboards report making critical financial decisions 4x faster than competitors relying on traditional reporting cycles.

5. Advanced Data Integration Across Multiple Business Platforms

The siloed business is officially dead in 2025.

Today’s remote accounting services seamlessly connect your accounting system with everything else:CRM, inventory, payroll, e-commerce, you name it.

This integration eliminates the data entry jobs nobody wanted anyway. When a customer places an Today’s remote accounting services seamlessly connect your accounting system with everything else:CRM, inventory, payroll, e-commerce, you name it.

The error reduction is impressive: businesses report 91% fewer data entry mistakes after implementing these integrated systems.

And the best part? These connections are now mostly plug-and-play. What used to require expensive custom development now takes minutes to set up. Your accounting team spends time analyzing data instead of inputting it