Online vs. Local Bookkeeping Services: Which Is Best for Your Business?

You’re staring at another stack of receipts at 11 PM, wondering if this is really the best use of your time as a business owner. Sound familiar? Whether you’re drowning in paperwork or paying more than you should for basic bookkeeping, there’s a better way. The choice between online vs. local bookkeeping services isn’t just about cost—it’s about finding the right financial partner for your unique business needs.

I’ve watched clients transform their financial management by making the switch to the right bookkeeping solution. Some saved thousands while gaining 24/7 access to their numbers. Others found peace of mind working face-to-face with someone who understood their local market.

Understanding the Core Differences Between Online and Local Bookkeeping

1. Key Features of Online Bookkeeping Services

Online bookkeeping has completely changed the game for businesses of all sizes. Unlike the old days of dusty ledgers and in-person meetings, today’s digital services offer real-time access to your financial data from anywhere with an internet connection.

The biggest advantage? Accessibility. Log in at 2 AM in your pajamas to check your cash flow—nobody’s judging. Most online platforms come with user-friendly dashboards that visualize your financial health, making complex numbers digestible even for the finance-phobic.

Automation is another game-changer. Those tedious, repetitive tasks that used to take hours? Many online services can handle them automatically—expense categorization, invoice generation, and even payment reminders. Your time is better spent growing your business, not manually entering data.

Cost savings are substantial too. Without physical office overhead, online bookkeepers typically charge 20-40% less than their local counterparts. Plus, most offer scalable pricing models that grow with your business.

Security has come a long way. Reputable online bookkeeping services now employ bank-level encryption and multi-factor authentication. Your financial data is often safer in the cloud than sitting in a filing cabinet in your office.

2. What Traditional Local Bookkeeping Offers

Despite the digital revolution, local bookkeeping maintains distinct advantages that keep many businesses loyal to the traditional approach.

Face-to-face interaction remains invaluable for many business owners. There’s something reassuring about sitting across from someone who knows your business intimately and can explain complex financial matters in person. That relationship-building aspect creates trust that’s hard to replicate through a screen.

Local bookkeepers bring localized expertise that online services may lack. They understand your community’s economic conditions, local tax nuances, and industry-specific challenges in your area. When your bookkeeper personally knows the economic landscape of your neighborhood, they can provide more tailored advice.

Immediate assistance during crises can be a lifesaver. When tax deadlines loom or financial emergencies strike, having someone who can rush to your office with minimal notice provides peace of mind that digital services struggle to match.

For businesses with primarily paper-based operations or those dealing with physical inventory, local bookkeepers can physically handle documents and directly observe operations—something impossible for virtual services.

There’s also typically less technology learning curve. If you’re not particularly tech-savvy, the simplicity of handing over your documents and receiving organized reports without navigating new software can be appealing.

The Evolution of Bookkeeping in the Digital Age

Bookkeeping has traveled a remarkable journey from ancient Mesopotamian clay tablets to today’s AI powered systems. The digital revolution didn’t happen overnight—it’s been a gradual transformation accelerating rapidly in recent years.

The 1980s introduced the first computerized bookkeeping systems, clunky by today’s standards but revolutionary then. QuickBooks desktop software in the 1990s marked a major shift, bringing professional grade tools to small businesses for the first time.

The real game-changer came in the mid-2000s with cloud-based solutions. Suddenly, financial data wasn’t trapped on a single computer—it became accessible from anywhere, enabling real-time collaboration between business owners and financial professionals.

Today’s landscape features sophisticated ecosystems where bookkeeping software integrates seamlessly with payment processors, inventory management, payroll systems, and banking platforms. The entire financial workflow can now exist in a continuous digital loop with minimal manual intervention.

This evolution has democratized financial management. Small businesses today have access to tools previously available only to large corporations with dedicated accounting departments. A solo entrepreneur can now maintain financial records with the same sophistication as businesses many times their size.

How Technology Has Transformed Financial Management

How Technology Has Transformed Financial Management Technology hasn’t just changed bookkeeping—it’s completely reinvented financial management from the ground up.

Artificial intelligence and machine learning now power expense categorization with astonishing accuracy. Upload a receipt, and systems can identify the vendor, amount, tax status, and appropriate category faster than any human could. These systems actually learn from corrections, becoming more accurate over time.

Mobile technology has put financial management in everyone’s pocket. Business owners can now capture receipts, approve payments, check cash flow, and even run payroll from their smartphones while waiting for coffee.

Data visualization tools transform complex financial information into intuitive dashboards. Instead of trying to decipher rows of numbers, you can instantly understand trends through charts and graphs that highlight what matters most to your business.

Predictive analytics represents perhaps the most revolutionary advancement. Modern systems don’t just tell you what happened yesterday—they can forecast cash flow issues before they arise, predict seasonal.

fluctuations, and even suggest optimal timing for major purchases based on your financial patterns. Integration capabilities mean your financial data flows automatically between systems. When a customer pays an invoice through your payment processor, that information updates your bookkeeping software, which updates your tax preparation system, eliminating duplicate data entry and reducing errors.

When Online Bookkeeping Makes Sense

Online bookkeeping is a fantastic fit for modern, tech-savvy businesses that thrive in the digital space. If you’re running an e-commerce store, a SaaS company, or a remote-first business, online bookkeeping aligns seamlessly with how you operate.

Startups and solo entrepreneurs also benefit tremendously. With limited budgets and fast-moving growth,having a scalable, affordable, and automated system is a game-changer. You can start with basic services and expand as your needs evolve—without switching platforms or providers.

Businesses with distributed teams or multiple locations love the flexibility of cloud access. Your team in New York and your accountant in Texas can view the same dashboard in real-time without juggling spreadsheets.

And let’s not forget the convenience: online bookkeeping fits your schedule, not the other way around. No more driving across town to drop off receipts or scheduling face-to-face meetings just to answer a few questions. Everything you need is at your fingertips—whenever you need it.

When Local Bookkeeping Is the Better Choice

While digital tools are amazing, they’re not ideal for everyone. If your business handles a high volume of physical paperwork, operates primarily in cash, or involves complex inventory systems, local bookkeepers can offer hands-on support that online services can’t match.

Brick-and-mortar stores, medical practices, law firms, or restaurants often prefer the assurance of having someone physically present who understands the nuances of their operations. Local bookkeepers can walk through your workflow, help implement systems on-site, and literally sit beside you when issues arise.

Trust and relationship-building also play a role. Some business owners simply value face-to-face communication. They want someone who knows their name, visits their store, and understands the local tax regulations without needing an explainer.

And when tax season hits or an audit looms, there’s comfort in knowing your bookkeeper can drive to your office and sort things out in person.

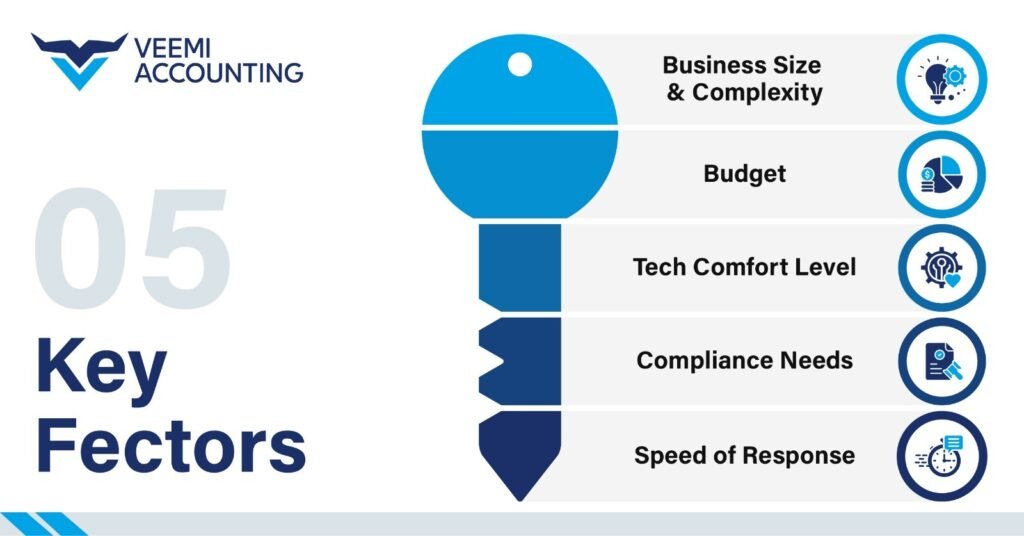

Key Factors to Help You Decide

- Business Size & Complexity: Smaller operations or digital businesses usually benefit more from online solutions, while larger or traditional businesses might need the personal touch of a local pro.

- Budget: online bookkeeping is generally more cost-effective, especially for businesses that don’t require intensive support

- Tech Comfort Level: If you’re comfortable using digital tools and cloud-based apps, online services are a breeze. If not, local might feel more natural

- Compliance Needs: If your business deals with complex tax rules (e.g., multi-state or industry specific regulations), a local expert could provide deeper insights.

- Speed of Response: Need answers quickly via Slack or email? Online works great. Prefer a phone call or in-person chat? Go local.

Is Hybrid Bookkeeping the Best of Both Worlds?

More and more businesses are choosing hybrid bookkeeping models—combining the best aspects of both online and local services. This might look like working with a virtual firm that offers occasional in-person consultations or partnering with a local accountant who also provides cloud access to your books.

Hybrid models can deliver high-tech efficiency without sacrificing the personalized service many business owners value. And as virtual tools continue to evolve, we’re likely to see more providers offering this type of flexible, blended solution.

Final Verdict: Which Is Best for Your Business?

Ultimately, the “right” bookkeeping solution depends on your unique business needs, preferences, and goals.

If you value convenience, affordability, and flexibility—online bookkeeping is likely your best bet.

If you prioritize personal relationships, hands-on help, or operate in a paper-heavy environment—local bookkeeping might serve you better.

There’s no one-size-fits-all. But by understanding the pros, cons, and use cases for both, you can make an informed choice that saves you time, reduces stress, and keeps your financial house in order.

Frequently Asked Questions?

1. Is online bookkeeping secure?

Yes, most online bookkeeping platforms use bank-grade encryption, secure cloud storage, and two-factor authentication to keep your data safe. In many cases, your financial information is more secure in the cloud than stored on paper or a local hard drive.

2. Can I switch between online and local bookkeeping?

Absolutely. Many businesses start with one method and transition to the other as they grow or their needs change. Some even adopt a hybrid approach to get the best of both worlds.

3. What’s the typical cost difference?

Online bookkeeping services often range from $99 to $250 per month, while local bookkeepers may charge $30 to $75 or more, depending on experience and services offered.

4. Which industries benefit most from online bookkeeping?

E-commerce stores, tech startups, remote agencies, consultants, and service-based businesses tend to benefit the most from online bookkeeping. These industries often prioritize flexibility, real-time access, and digital integrations.

Still unsure which path is right for

your business?

Schedule a free consultation with our bookkeeping experts. Whether you want digital convenience, local expertise, or a custom hybrid model, we’ll help you make the best choice for your business.