How Top Restaurants in 2025 Are Doubling Profits Through Smarter Accounting

In 2025, the restaurant industry is under more pressure than ever. On one hand, consumers are spending heavily on dining experiences. Globally, the restaurant and food service sector is projected to hit around USD 1.5 trillion in sales this year. On the other hand, cost pressures like food inflation, labour, rent, and utilities continue to rise. For many independent restaurants, net profit margins remain in the range of 3 to 5 percent.

Yet some top restaurants are not only maintaining restaurant profitability 2025 but doubling their profits. Their secret is not a new cuisine or a viral trend. It is smarter accounting for restaurants. This includes real-time data visibility, integrated systems, menu engineering, tighter restaurant cost control strategies, and more strategic decision-making.

This blog takes a deep look at how the best operators in the U.S., U.K., Australia, and global markets are using restaurant accounting 2025 as a strategic growth engine. You will learn:

- Why restaurant accounting is now a competitive advantage

- Which financial metrics matter most in restaurant financial management 2025

- How restaurant accounting automation and cloud accounting for restaurants are transforming finance

- Key restaurant cost reduction techniques that drive restaurant margin improvement

- How menu engineering boosts profitability

- Real-world insights from operators who are doubling profits

- A step-by-step plan to apply smarter accounting for restaurants in your business

Why Smarter Accounting Is a Competitive Advantage in 2025

In the past, restaurant accounting often meant spreadsheets, invoices, and monthly reports. That is no longer enough. Smarter accounting for restaurants in 2025 is about real-time visibility, automation, integrated POS and inventory systems, predictive insights, and strategic use of financial data.

The margin squeeze

For many independent restaurants, net margins remain in the low single digits. Rising ingredient costs, higher wages, expensive packaging, and energy bills are creating pressure from all sides. Meanwhile, competition is getting tougher with delivery, ghost kitchens, and chain expansions.

The opportunity

This same pressure creates an opportunity for those who master their numbers. Restaurants that adopt restaurant accounting automation, control costs tightly, and make faster data-driven decisions are seeing meaningful margin lifts. Many are improving net margins by 10 to 15 percent through restaurant cost control strategies, better menu planning, and cloud accounting for restaurants.

Key Financial Metrics for Restaurants to Monitor

If you want to double profits, you need to track the right numbers. These are the most important metrics in restaurant financial management 2025.

Prime Cost

Prime cost equals Cost of Goods Sold (COGS) plus total labour cost. Healthy prime cost targets usually lie between 60 and 65 percent of sales. Monitoring prime cost daily or weekly helps spot problems like waste, over-labour, or ingredient price creep before they cut into profit.

Cost Of Goods Sold (COGS)

COGS is the cost of ingredients and beverages used to produce your menu items. A common target for COGS is between 30 and 35 percent of sales, depending on the concept. If COGS creeps up without price or efficiency adjustments, your margins shrink quickly.

Labour Cost

Labour costs typically account for 25 to 35 percent of sales in many restaurants. Rising wages in the U.S., U.K., and Australia make it critical to manage staffing with precision. Forecasting, scheduling, and cross-training help keep this under control.

Gross Profit and Net Profit

- Gross profit = Total revenue minus COGS

- Net profit = Revenue minus all expenses including COGS, labour, rent, utilities, and overhead

Many restaurants operate with gross profit margins between 40 and 70 percent, but net profit margins remain around 3 to 5 percent. Lifting net profit even a few points can dramatically change financial outcomes.

Daily and Weekly Sales Tracking

Top restaurants do not wait until month-end. They monitor daily and weekly sales against budget and adjust staffing, purchasing, and promotions in real time.

Waste and Spoilage

Waste from overproduction, spoilage, and poor portion control can quietly erode profit. Leading operators track it carefully as a line item, not an afterthought.

Contribution Margin by Menu Item

It is not enough to know your best sellers. You must know which menu items actually drive profit. A popular but low-margin dish may be holding your business back.

Cash Flow and Liquidity

Strong cash flow is what keeps a profitable restaurant alive. Monitoring payables, inventory turnover, and working capital ensures you can grow without financial stress.ivable Management is a very important link between making money and having cash in your hands.

How Automation and Cloud Accounting Are Transforming the Game

One of the biggest profit drivers in 2025 is technology. Restaurant accounting automation and cloud accounting for restaurants are changing the way operators see and use financial data.

Why it matters

- Real-time financial insight replaces waiting for monthly reports

- Faster cost control and cash flow management

- POS, payroll, inventory, and accounting systems work together

- Easier forecasting and scenario planning

Key trends and tools

- Cloud-based accounting platforms tailored for hospitality

- Dashboards that combine sales, inventory, labour, and cost metrics

- Predictive analytics that forecast busy periods and demand

- Automation for payroll, invoicing, inventory tracking, and vendor payments

- Outsourced specialist accounting for efficiency and scale

Faster decisions mean stronger margins

When operators can see their numbers daily, they can adjust quickly. Reducing overstaffing, cutting slow-moving ingredients, or renegotiating vendor terms in real time can produce significant restaurant margin improvement.

Cost Control Strategies That Drive Margin Improvement

Better accounting only matters if it leads to better action. Here are the key restaurant cost control strategies top restaurants use.

Food and Beverage Cost Control

- Supplier negotiation: Regularly review vendor contracts, consolidate orders, and track price movements.

- Inventory management: Use automation, FIFO systems, and accurate counting.

- Menu engineering: Focus on high-margin dishes and remove or reprice low-margin ones. Restaurants that align their menus with cost and margin data see 10 to 15 percent profit improvements.

- Portion control: Standardize recipes and train kitchen teams.

- Seasonal and local sourcing: Switch menus based on ingredient availability.

- Packaging efficiency: For delivery-heavy operations, use packaging that protects product quality without inflating costs.

Labour Cost Control

- Staffing forecasts: Align schedules with actual demand.

- Cross-training: Use flexible teams to reduce idle labour.

- Productivity tracking: Monitor sales per labour hour.

- Scheduling tools: Automate and simplify workforce management.

Overhead and Fixed Cost Control

- Rent and lease reviews: Negotiate where possible, use space efficiently.

- Utilities: Monitor usage patterns and invest in energy efficiency.

- Maintenance: Preventive maintenance saves expensive downtime.

- Marketing ROI: Focus on campaigns that deliver measurable revenue.

Revenue Diversification and Upselling

- Catering and events: Alternative revenue streams help balance slow days.

turnover ratios, to improve the AR process. - Delivery and take-out: These now represent a significant share of revenue.

- High-margin specials: Promote items with strong contribution margins.

- Loyalty and upselling: Increase average check size strategically.

Menu Engineering and Pricing Strategy: A Hidden Multiplier

Menu engineering is one of the most powerful ways to improve profit without raising prices across the board.

Why menu engineering works

A menu item can be popular but unprofitable. By analyzing item performance based on margin and popularity, restaurants can reshape their offerings to prioritize profit. Many operators see a 10 to 15 percent net profit lift through structured menu engineering alone.

Tactics that work

- Build a menu-item profitability matrix

- Highlight high-margin items visually on the menu

- Adjust pricing to reflect cost changes or demand

- Use limited-time offers to test high-margin items

- Simplify the menu to reduce waste and complexity

- Optimize delivery menus separately from dine-in

Data-driven decisions

Modern restaurant accounting 2025 and POS systems make menu analysis faster and more accurate. Instead of gut feeling, operators rely on data to design menus that support stronger margins.

How Top Restaurants Are Doubling Profits: Real-World Insights

1. Real-time dashboards and early action

Operators who track prime cost daily and watch variance closely can respond early. Adjusting labour schedules or purchasing plans ahead of time protects margins.

2. Chains and independents both benefit

Large chains scale efficiencies faster, but independent restaurants are also closing the gap with restaurant accounting automation and outsourced accounting. With strong systems, even a single-unit operator can act like a chain.

3. Menu optimization is a profit lever

Restaurants that regularly update their menu based on cost and margin data are consistently reporting 10 to 15 percent improvement in net profits.

4. Delivery and off-premise operations

Third-party delivery now accounts for 25 to 40 percent of revenue in many mature markets. Top operators treat delivery as a separate business unit with its own P&L and cost structure.

5. Specialist accountants are on the rise

Many restaurant owners are turning to specialist accounting firms rather than general accountants. Industry expertise leads to sharper restaurant cost reduction techniques and better strategic decisions.

6. Margins matter more than top line

Top restaurants focus less on headline sales growth and more on sustainable restaurant margin improvement. Even a two-point net profit lift can double earnings.

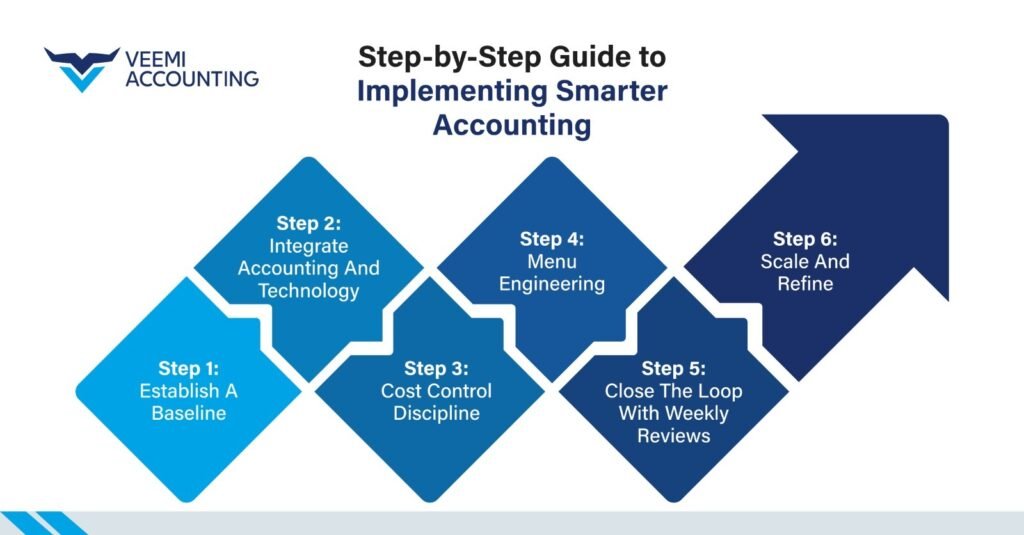

Step-by-Step Guide to Implementing Smarter Accounting

Step 1: Establish a baseline

- Review 12 months of financials

- Calculate prime cost, COGS, labour cost, gross and net margins

- Set clear targets for improvement

Step 2: Integrate accounting and technology

- Choose a cloud accounting for restaurants system

- Integrate POS, inventory, payroll, and reporting

- Build daily and weekly dashboards

Step 3: Cost control discipline

- Implement inventory audits and waste tracking

- Forecast labour needs precisely

- Negotiate supplier contracts regularly

- Review utilities and overhead quarterly

Step 4: Menu engineering

- Categorize menu items by popularity and margin

- Promote Stars, fix or drop Dogs

- Introduce seasonal items strategically

- Monitor mix shifts regularly

Step 5: Close the loop with weekly reviews

- Compare actual performance to forecast

- Investigate variances

- Act quickly on cost or revenue issues

- Share KPI dashboards with your team

Step 6: Scale and refine

- Standardize reporting across units

- Benchmark high and low performers

- Adjust targets quarterly

Stay agile with market shifts

Common Mistakes and How to Avoid Them

- Relying only on monthly reports instead of daily or weekly dashboards

- Measuring sales without margin visibility

- Using generic accounting systems that don’t integrate with POS or inventory

- Ignoring menu profitability data

- Treating delivery as just another revenue channel without cost clarity

- Failing to build accountability and financial culture among staff

Tailoring to USA, UK, AUS and International Markets

While the principles of smarter accounting for restaurants remain the same worldwide, their application varies by market.

Rising operating costs

In the U.S., U.K., and Australia, food inflation and labour costs have risen between 5 and 12 percent year-over-year. Daily and weekly cost tracking has become standard.

Labour compliance complexity

These markets have strict labour laws. Automated scheduling and payroll integration are crucial to avoid violations and extra costs.

Taxation and reporting

Restaurants in these countries face complex tax structures and reporting requirements. Cloud accounting for restaurants that automate compliance are widely used.

Consumer behavior

Diners in these countries value experience, service, and convenience as much as food. Strong restaurant cost control strategies allow restaurants to maintain quality without constant discounting.

Delivery and multi-channel revenue

Delivery and take-out account for 25 to 40 percent of revenue in many markets. Top restaurants maintain separate cost and profit tracking for these channels.

Rapid tech adoption

Restaurant accounting automation, integrated POS, dashboards, and predictive analytics are now common even for mid-sized operators.

Sustainability as a financial lever

Reducing food waste, energy consumption, and packaging costs has become a profit driver as well as a brand advantage.

Franchising and expansion

Many operators in these countries expand regionally or internationally once margins stabilize. Standardized accounting and KPI systems make this easier and more attractive to investors.

Why This Matters

When you implement smarter accounting for restaurants, you are not just cutting costs. You are building a more resilient, profitable, and scalable business.

- A 3-point improvement in prime cost can double net profit.

- Better cash flow means more reinvestment and growth.

- Strong financial systems make expansion or exit easier.

In volatile times, data gives you control.

Future Outlook

- Predictive analytics will become more mainstream in restaurant finance

- Hybrid accounting models combining software and expert advisory will grow

- Guest data will merge with financial data for targeted menu and pricing strategies

- Sustainability initiatives will be tied to both branding and cost savings

- Multi-channel accounting will be essential for growth-focused operators

Conclusion

The restaurant industry in 2025 is full of opportunity and challenge. Costs are rising, competition is intense, and customer expectations are evolving. The restaurants that are winning are not just relying on good food or footfall. They are mastering their numbers.

Smarter accounting for restaurants means real-time data, strong cost control, strategic menu engineering, automation, and financial discipline.

Top restaurants are:

- Tracking prime cost daily

- Automating accounting and compliance

- Using menu engineering as a profit lever

- Managing delivery and dine-in with separate strategies

- Building scalable, transparent financial systems

Whether you are in New York, London, Sydney, or any major city, these principles work. In many cases, they are the reason some operators double their profits while others just survive.Now is the time to treat restaurant accounting 2025 not as a back-office chore but as your most powerful strategic toolrent, compliant, and future-ready, just the way they should be.