A Complete Guide on Real Estate Accounting

The real estate sector is quick to react to changes. Properties are purchased, sold, leased out, and managed on a daily basis. Real estate accounting is the behind-the-scenes element that ensures everything stays on track. It is essential for all parties involved in the property management industry, including landlords, investors, and property managers, to have a thorough grasp of the basic principles of property accounting and real estate bookkeeping in order to make lucrative judgments, remain compliant, and avoid making expensive errors.

This tutorial will bring you through all you need to know, from the fundamentals of real estate accounting basics to more complex topics like real estate depreciation, capital expenditures vs repairs (CAPEX vs OPEX), and even the finest solutions to expedite your work, such as QuickBooks for real estate.

The Importance of Real Estate Accounting

In the field of real estate, accounting is the language that is used to communicate about your investments, just as it is the language that is used to communicate about business in general. Property accounting is different from other businesses in that it has its own distinct set of standards. These include monitoring rental income accounting, managing mortgages, calculating depreciation, and managing costs that are related to properties.

For novices, gaining a knowledge of real estate accounting for beginners is not just a matter of doing mathematical calculations. It is related to the development of a system that is able to sustain profitability over an extended period of time. If executed correctly, it will provide you with:

- A transparent overview of the accounting for rental properties

- Understanding the difference between capital expenditures vs repairs

- Precise reporting of taxes

- Decisions made with more knowledge for dealings down the line.

The Fundamentals of Real Estate Accounting

If you are curious about how to do real estate accounting, let’s examine the fundamental components.

1. Monitoring of Income

The majority of your earnings come from property-related revenue, including late fees, rent, and other sources. It is important to maintain organized financial records for rental properties accounting in order to have a clear understanding of incoming funds and their timing.

2. Management of Expenses

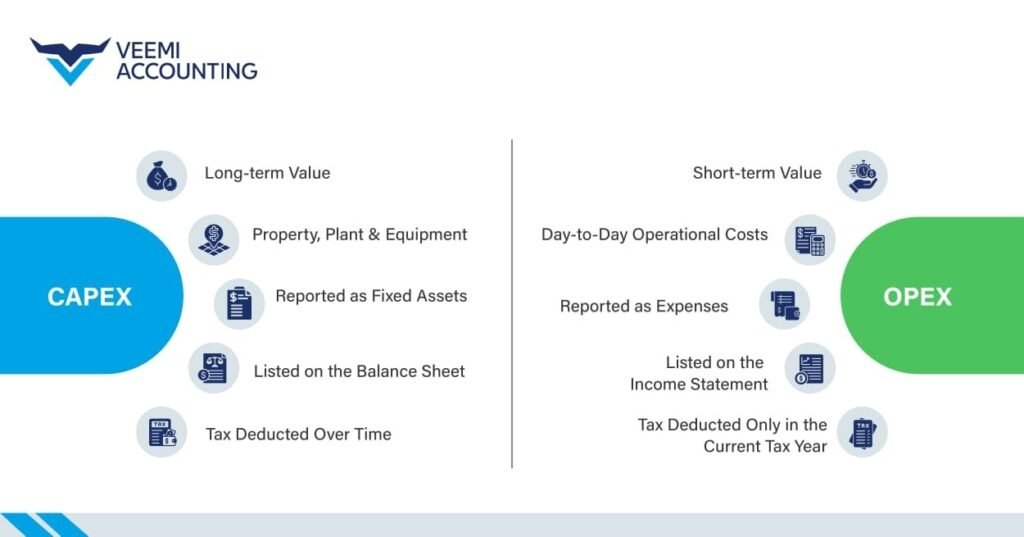

Mortgage payments, repairs, insurance, property taxes, and utilities are all examples of expenditures. Distinguishing between CAPEX vs OPEX allows you to distinguish between expenses that may be written off immediately and those that must be capitalized.

3. Balance Sheets and Reports

Having a sound chart of accounts for real estate is essential. It sorts your financial information into categories such as income, spending, assets, and obligations, which simplifies reporting and reduces the stress that comes with tax season.

Real Estate Bookkeeping vs Accounting

The two phrases are used synonymously by many people, yet they really have different meanings.

- The daily tracking of expenditures and earnings is referred to as real estate bookkeeping.

- Examining financial health, compiling statements, and planning for expansion are all components of real estate accounting, which encompasses the broader picture.

Both are of great importance. The basis of your organization is built on bookkeeping, and accounting is the system that is built on top of that foundation to give strategy.

The Function That Property Accounting Plays for Various Parties

- Landlords should use rental income accounting in order to monitor their cash flow.

- Investors are individuals or organizations that commit their capital with the expectation of achieving a profit. Detailed accounting for real estate investors is required to calculate return on investment (ROI) and tax deductions.

- Property managers depend on property management accounting software in order to handle several units effectively.

Every group has its own objectives, yet all of them rely on numerical accuracy.

Real Estate Chart of Accounts Setup

The backbone of your financial system is your chart of accounts for real estate. It sorts items into categories:

- Properties and bank accounts are examples of assets.

- Liabilities (such as loans and mortgages)

- Earnings from rent, penalties for late payment

- Costs associated with repairs, management fees, and insurance

A well-designed system may save hours throughout tax season and give clarity on which assets are really lucrative.

CAPEX vs OPEX

Not all costs may be classified in the same way.

- Repairs (OPEX) → Addressing a dripping faucet or making repairs to a roof. Deducted without delay.

- Capital Expenditures (CAPEX) → Expenses such as installing a new roof or kitchen renovation. Capitalized and written off over time.

Being able to distinguish between capital expenditures vs repairs (CAPEX vs OPEX) is beneficial for both budgeting and tax planning.

Accrual vs Cash Accounting Real Estate

There are two primary techniques that you may choose from:

- Cash accounting real estate: Income and costs are documented at the point when money is exchanged. Something straightforward and often used by small-scale property owners.

- Accrual accounting real estate: Record revenue and costs at the time that they are generated or incurred, regardless of cash flow. Portfolios that are greater in size will benefit more from this.

The choice between accrual vs cash accounting real estate relies on the size of your activities and your tax approach.

Best Real Estate Accounting Software

It’s a nightmare to keep track of every transaction by hand. That is the point at which technology is brought in. The best real estate accounting software automates bookkeeping, reporting, and compliance tasks. Some popular options are:

- Simple to use and very compatible with other software, QuickBooks for real estate is a fantastic solution for landlords of small to medium-sized businesses.

- Property management accounting software → Customized to meet the needs of managers that oversee several units, including features such as maintenance monitoring, tenant portals, and rent collecting.

Using the correct software lowers mistakes and saves time, two things that every property owner places a high value on.

The Correct Method for Handling Real Estate Accounting: A Step-by-Step Guide

For novices, I have a simple foundation to get you started:

- Create individual bank accounts for each property.

- A chart of accounts for real estate specifically tailored for the industry.

- Keep a record of all sources of revenue and all expenses (rent, mortgage, repairs).

- Keep track of real estate depreciation on a yearly basis.

- Understand the difference between capital expenditures vs repairs.

- Create reports on a monthly basis.

- Increase your productivity by using property management accounting software.

This method serves as the basis for the fundamental principles of real estate accounting basics.

Frequent Errors Made in Real Estate Bookkeeping

You may save thousands of dollars by steering clear of these errors.

- Combining funds related to both personal and property matters

- Failing to keep a record of minor expenditures

- CAPEX vs OPEX being incorrectly categorized

- Rental income accounting is not being tracked systematically

- Overlooking advantages that may come from real estate depreciation

This implies that you might be successful on paper but yet show a loss for tax purposes. It is considered to be one of the most potent instruments for accounting for real estate investors.

Expert Advice on Accounting for Real Estate Investors

If you are handling many properties or significant assets, consider the following:

- Establishing limited liability companies (LLCs) or corporations for the purpose of protecting against liabilities.

- Achieving precision via the use of accrual accounting real estate.

- Making use of sophisticated reports in order to compare how properties are doing.

- Collaborating with certified public accountants (CPAs) who have expertise in real estate accounting.

As your portfolio grows more sophisticated, the accounting that you do becomes more strategic.

Concluding Thoughts

Keeping the IRS satisfied is just one aspect of real estate accounting. It pertains to developing a knowledge of the narrative that your data tell. The concepts remain the same whether you are focused on real estate accounting for beginners, an established investor dealing with accrual vs cash accounting real estate, or a property manager searching for the best real estate accounting software. Track your revenue, manage your spending, prepare for taxes, and use programs such as QuickBooks for real estate to simplify your life.

The objective is straightforward, no matter whether you are concentrating on rental income accounting, examining real estate depreciation, or constructing a robust chart of accounts for real estate: clarity, compliance, and cash flow.

In a nutshell, become an expert in real estate bookkeeping today, and you will become an expert in wealth tomorrow.