A Complete Guide to Accounts Receivable Management

Accounts Receivable Management, or AR Management, is very important for any business that sells things or services on credit. When done right, it makes sure that debts are paid on time, cash flow stays positive, working capital is used to its fullest, and bad debt losses are kept to a minimum. Poor Receivables Management, on the other hand, can cause operations to be stressed, borrowing costs to rise, and financial danger.

You will learn the main ideas, measurements, methods, best practices, tools, and strategies you need to manage accounts receivable effectively with this guide.

What is management of accounts receivable?

Customers who bought things or services on credit but haven’t paid for them yet are due money by a business. This is called accounts receivable (AR). These are claims that can be enforced by the law.

Accounts Receivable Management, also known as AR Management, is the field of study, set of rules, credit policies, and methods used to keep track of, collect, manage accounts receivable, and lower the risk of debts. To put it more simply, it’s how you handle and manage accounts receivable so that it’s recovered quickly, easily, and with minimal risk.

You may also see “Receivables Management” or “Manage Accounts Receivable” used as a term.

The path from order to cash, also called credit to cash, includes AR Management. It works with business, credit, banking, customer service, payments, and sales. A good AR process makes sure that there is as little and reliable a time as possible between giving a service or product and getting paid.

Why AR management is important: pros and cons

Why is AR Management important for your business? Here’s why and what could go wrong:

The pros

Better cash flow

It’s better to meet wages, pay suppliers, and spend as soon as possible after debts are turned into cash. Managing accounts receivable well speeds up cash flow.

Better use of working capital

Capital is held up by receivables. Keeping your unpaid debts as low as possible frees up working capital that can be used for things like supplies, growth, and more.

Less bad debt and risk

You can lower the chance of bad debt write-offs by keeping an eye on customer credit, monitoring accounts that are past due, and pressing payment collection.

Better ability to predict money matters

You can more accurately predict cash flow when you have strong rules and key performance indicators (KPIs) in place. This makes budgeting, planning, and managing money easier.

Customer relationships that are stronger

A well-run AR Management function talks to customers clearly, settles disagreements quickly, and keeps customers happy, even when collecting.

Cost savings and better operations

You can cut down on overhead costs, reduce manual errors, and boost staff output by streamlining processes, implementing AR Automation, and having clear credit policies.

Challenges and risks

- Customers are taking too long to pay if you have a high Days Sales Outstanding (DSO).

- Payment delays are caused by unresolved disagreements or mistakes on invoices.

- Customers may not feel like they need to pay if the loan terms are too generous.

- If your credit rating isn’t very good, you might be giving credit to people who aren’t reliable.

- Not enough follow-up and tracking, so debts get old and can’t be collected.

- Manual methods that are prone to mistakes make receivables management slower and more costly.

In conclusion, Accounts Receivable Management is a very important link between making money and having cash in your hands.

Important AR Metrics: DSO, CEI, and More

To handle AR Management well, you need to monitor performance using Key Performance Indicators (KPIs).

Days Sales Outstanding (DSO)

Definition and Goal

DSO measures how long it usually takes to get paid after a sale. It is a way to measure how fast you can collect payments.

Method

DSO = (Accounts Receivable ÷ All Credit Sales) × Number of Days

Less DSO is better. Customers who take a long time to pay or a poor AR process could be to blame.

Collection Effectiveness Index (CEI)

Definition and Goal

CEI, or Collection Effectiveness Index, measures how much of your net debts were collected in a certain period. It is a way to measure the quality of receivables management.

Method

CEI = ((Beginning AR + Credit Sales − Ending AR) ÷ (Beginning AR + Credit Sales − Ending AR)) × 100

If your CEI is close to 100%, it means that you are successfully recovering almost all unpaid debts. A low CEI indicates inefficiencies in your AR process.

Other Useful KPIs and Metrics

- Accounts Receivable Turnover Ratio = Net Credit Sales ÷ Average Accounts Receivable

- Average Number of Days Past Due (ADD)

- Rate of Bad Debt to Sales

- Rate for Disputed Invoices

- High-risk accounts analysis

Monitoring these KPIs helps improve receivables management, cash flow, and reduce risk.

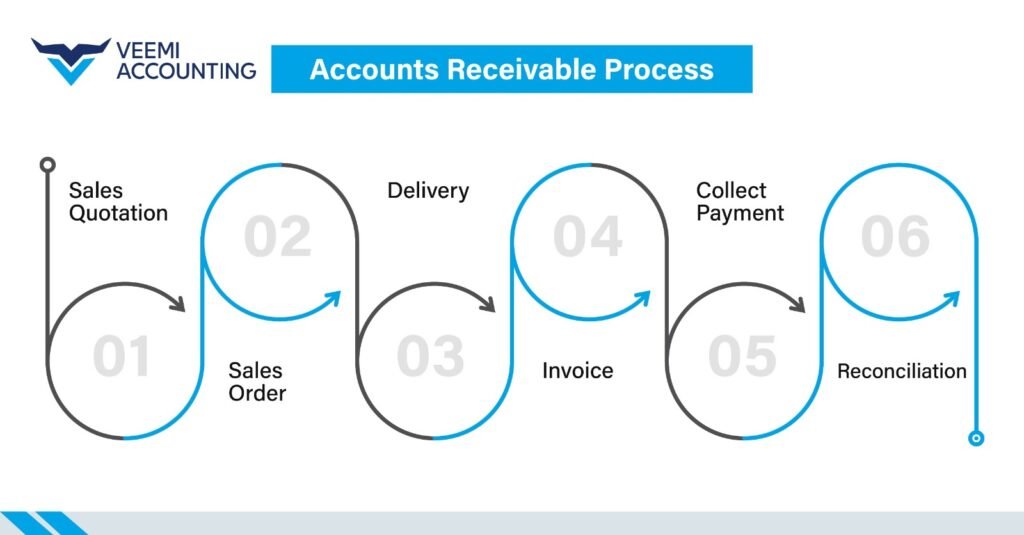

The AR Process: Steps and Actions

Managing accounts receivable is a series of coordinated steps:

- Welcoming new customers and checking credit (Credit Policies)

- Acceptance of the order and assignment of terms

- Invoicing

- Payment Collection and cash application

- Monitoring, follow-up, and collection

- Handling disputes and exceptions

- Aging, provisioning, and write-offs

Analysis, reporting, and metrics

4.1 Adding a customer and checking credit

Check finances, past trade, and references. Set clear credit limits as part of credit policies.

4.2 Acceptance of the order and assignment of terms

Ensure the order complies with credit policies. Set clear terms like “Net 30.”

4.3 Sending bills

Invoicing must be accurate, timely, and include all terms and supporting documents.

4.4 Getting Paid and Cash Application

Offer multiple payment collection methods and ensure proper cash application.

4.5 Checking, Following Up, and Collecting

Track overdue accounts. Use dunning processes for reminders and escalations.

4.6 Handling Disputes and Exceptions

Resolve disagreements quickly to maintain CEI and reduce DSO.

4.7 Aging, Provisioning, and Write-Offs

Manage bad debt risk and update financial records.

4.8 Analysis and Reporting

Generate reports on KPIs, including DSO, CEI, and turnover ratios, to improve the AR process.

Credit Policies

Strong credit policies are the first line of defense in Accounts Receivable Management:

- Criteria for credit approval

- Credit limits

- Payment terms

- Security or collateral

- Regular credit reviews

- Late fees and penalties

Invoicing and Getting Paid

Best Practices for Billing

- Timely invoicing

- Standardized invoice formats

- Clear payment instructions

- E-invoicing to improve cash flow

Payment Collection

- Reminders and alerts

- Payment plans for overdue accounts

- Incentives for early payment

Managing Disputes and Exceptions

Quick dispute resolution helps improve CEI and reduce DSO.

Strategies include root-cause analysis, SLAs, team coordination, record keeping, and escalation protocols.

Best Practices for Accounts Receivable

- Prioritize and segment accounts

- Maintain clean customer records

- Communicate payment terms clearly

- Automate reminders (AR Automation)

- Provide easy payment methods

- Track KPIs regularly

- Regular training and accountability

- Leverage AR Software and AR Management System

AR Systems, Software, and Automation

Modern AR Management Systems provide:

- Digital invoicing

- Payment gateways and automation

- Ageing dashboards

- Workflow management for dispute management

- Automated cash application

- Integration with ERP and banking systems

Automation improves CEI, reduces DSO, lowers bad debt, and boosts working capital.

Outsourcing AR

Companies may choose outsourcing AR or hybrid models to:

- Access experienced collection teams

- Reduce costs

- Focus internal teams on core tasks

Maintain consistent receivables management standards

Implementation and Change Management

Change Management Steps:

- Evaluate current tools, processes, and AR Management system

- Revise policies and design

- Test new tools with pilot groups

- Full rollout with KPI monitoring

- Continuous improvement

Early involvement of sales, customer service, and operations ensures smoother adoption and improved cash flow and working capital.

Summary and Last Words

Effective Accounts Receivable Management is critical for any business extending credit.

Key takeaways:

- Monitor DSO and CEI

- Implement strict credit policies

- Optimize the AR process

- Leverage AR Automation, AR Software, and AR Management Systems

- Consider outsourcing AR if needed

Strategic receivables management improves cash flow, strengthens working capital, and reduces bad debt, making your AR team a true competitive advantage.

At Veemi, we believe that smart financial management starts with strong foundations, and that’s exactly what our Accounting Services and Bookkeeping Services deliver. From efficient Accounts Receivable Management to precise month-end reconciliations, we help businesses maintain a clear picture of their cash flow and working capital at all times. Our expert accountants ensure your invoices, collections, and reports are handled with accuracy so you can focus on growth instead of chasing numbers.

When it comes to closing your books with confidence, our in-depth guide Month-End Close Process: All You Need to Know (2025 Guide) walks you through every step of creating a smooth and stress-free close cycle. Together, our services and insights make sure your finances stay transparent, compliant, and future-ready, just the way they should be.